Two Tokens, One Pool

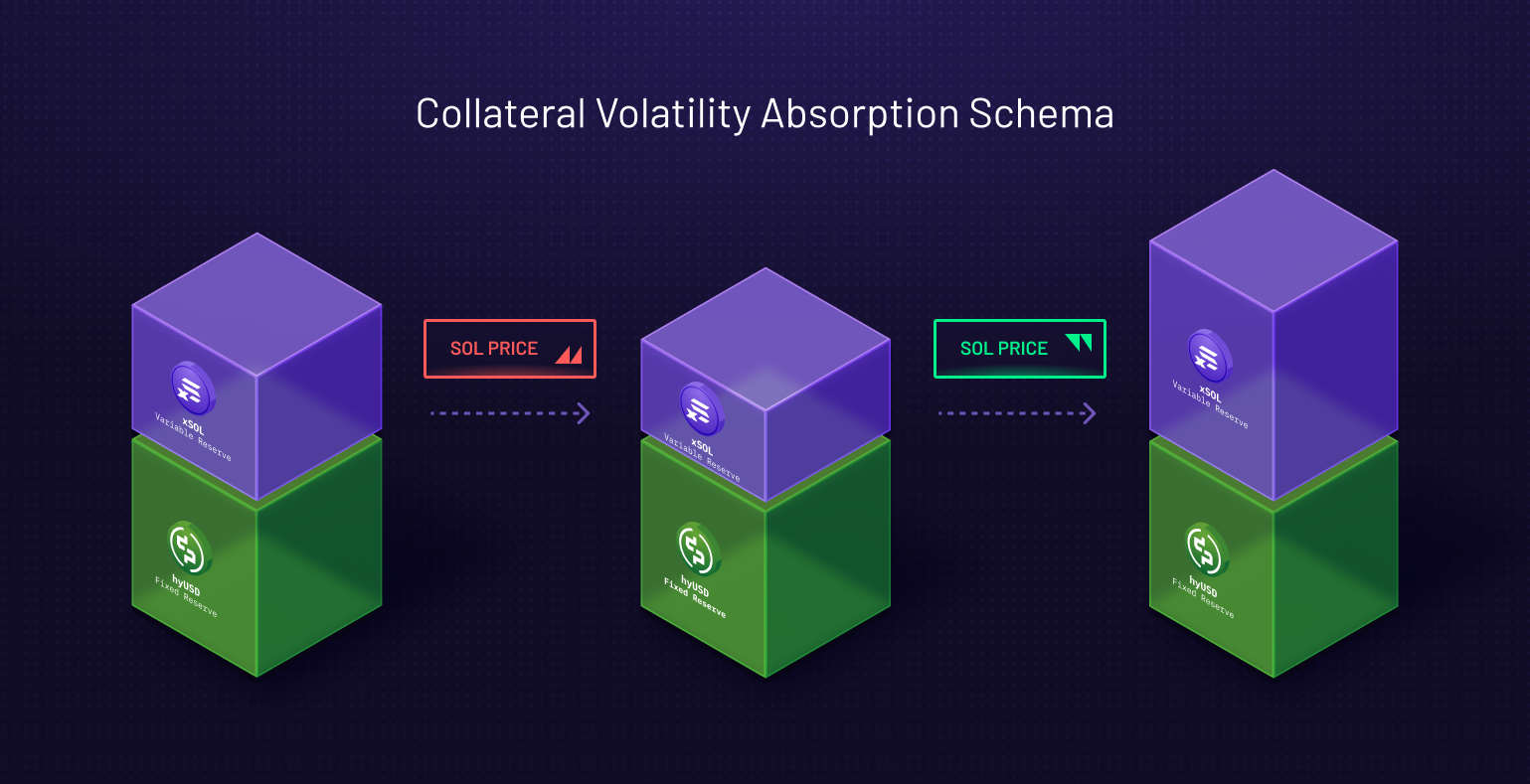

Hylo emits two tokens: hyUSD the flagship stablecoin, and xSOL a tokenized leveraged long position on SOL. hyUSD and xSOL are backed by a diverse basket of LSTs called the collateral pool. At any point in time, the sum of the two tokens’ market capitalizations is equivalent to the total dollar value locked in the pool. This property can be expressed with the Hylo invariant equation: What makes Hylo unique is the symbiotic relationship between xSOL and hyUSD. xSOL absorbs SOL price movements, allowing hyUSD to maintain a 1:1 peg with the US dollar in the face of market volatility. Simultaneously, excess value generated by the protocol’s LST reserves benefits xSOL holders with outsized gains.Pricing hyUSD & xSOL

The price of the hyUSD token is always fixed at $1 USD - it’s a stablecoin! The price of xSOL is calculated from the amount of “variable reserve” in the collateral pool, which is the excess value not reserved to back hyUSD. The Hylo equation can be rearranged to show how the protocol automatically adjusts xSOL’s price: As the value of the variable reserve grows, implying a price appreciation in SOL, the price of xSOL increases with effective leverage. Likewise if the SOL price dips the value of xSOL decreases, absorbing the volatility witnessed by the entire pool to maintain hyUSD’s peg.Example: xSOL price adjustment

Example: xSOL price adjustment

Let’s explore how the price of xSOL changes in response to SOL price fluctuations:

- Initial Scenario

- SOL Price Increases

- SOL Price Drops

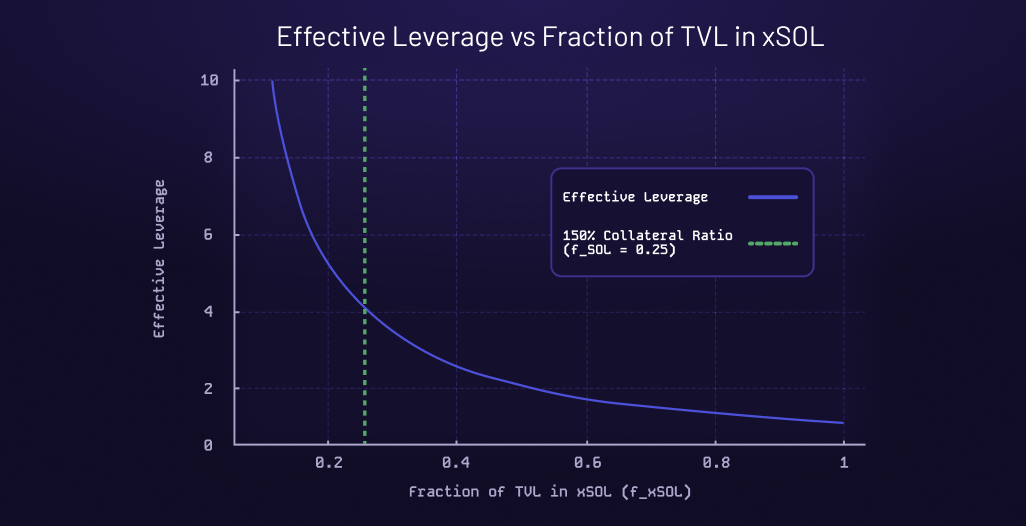

Effective Leverage on xSOL

Effective leverage is a dynamic measure reflecting the xSOL token’s exposure to price movements in the underlying SOL. It is computed as the ratio of the system TVL to the market capitalization of xSOL: xSOL’s leverage fluctuates dynamically with activity. It rises when hyUSD is minted or xSOL is redeemed, as these increase the amount of collateral relative to xSOL supply. Conversely, it falls when hyUSD is burned or new xSOL is minted. The effective leverage is inversely related to the proportion of TVL in xSOL: a higher xSOL fraction results in lower leverage, as shown in the graphic below.Example: xSOL leverage

Example: xSOL leverage

Let’s explore how the effective leverage of xSOL changes in different scenarios:

- Initial Scenario

- After hyUSD Minting

- After hyUSD Redemption